Fresh, Practical Perspectives To Cement Strategic Resilience & Increase Regulatory, AI & Geopolitical Responsiveness For

Navigating The Latest Regulations ■ Compliant & Customer-Focused AI ■ Operational Resilience ■ Cybersecurity & Technology Risk ■ Risk Culture & Governance ■ ESG, Climate & Sustainability ■ Fraud & Financial Crime ■ Geopolitical Risk ■ Streamlined Data & Analytics

■ Emerging Risks

10th Edition One-Day, Industry-Led Conference & Networking Exhibition, One America Square, London, 29th April 2026

26+ Financial Services speakers. Your one-day, essential update for financial services regulations returns to central London: From changing regulations to AI to geopolitical risks and risk cultures, this is the home for risk professionals seeking to expand their regulatory awareness and adopt practical, robust new risk strategies across their organisations.

Send your team: For more information, please call +44 (0) 203 479 2299 or email info@thefinancialservicesconference.com

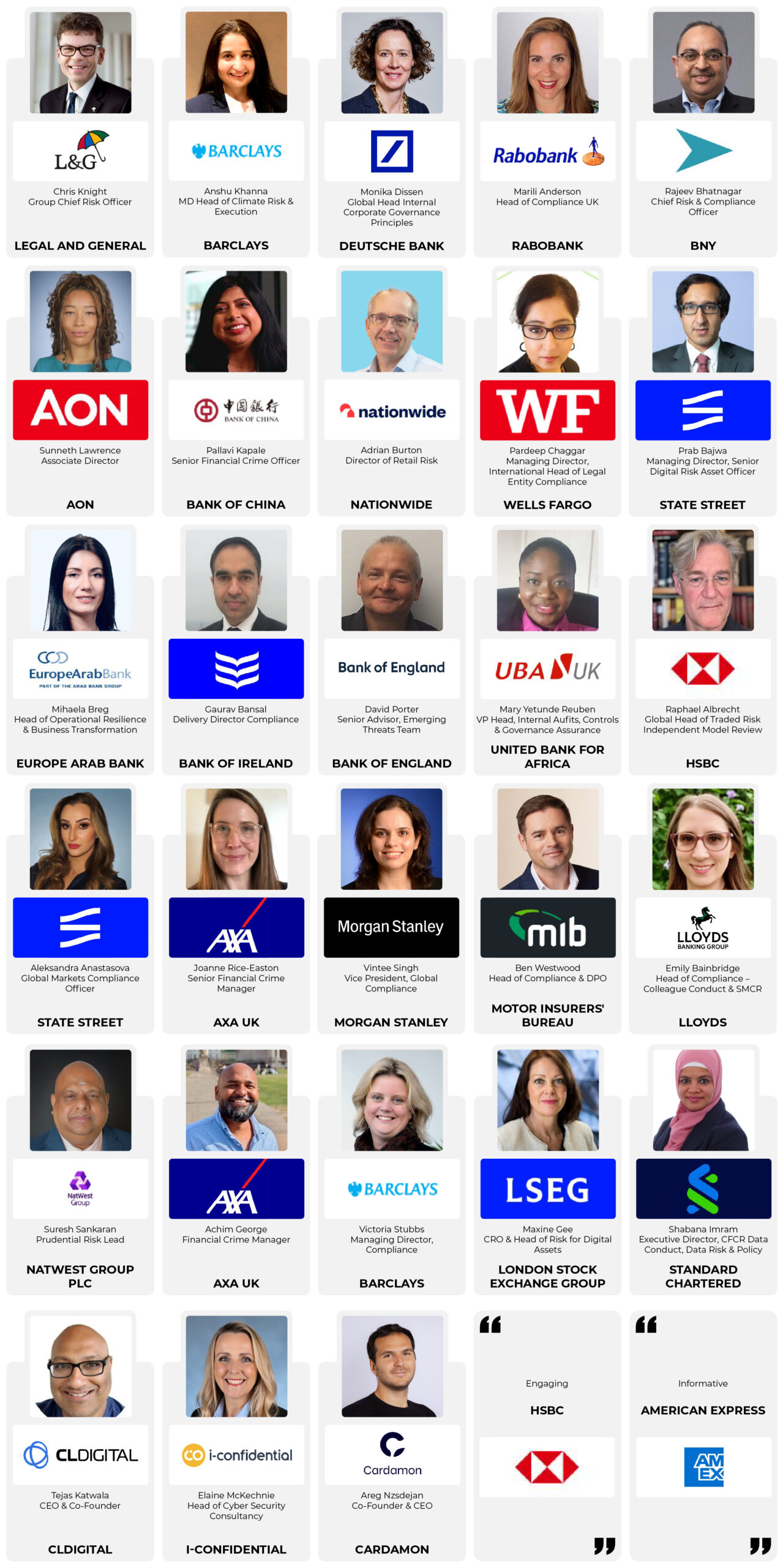

26+ Financial Services Risk & Compliance Practitioners Return To Speak At Our 10th Edition Event: Practical Responses To The Latest Regulations & The Future Of Risk & Compliance In Financial Services, Discussing Geopolitical Risks, Effective & Compliant AI Implementation, Crucial Sustainability & Climate Risk Insights, Analysing Emerging Risks & New Technologies & Safeguarding Against Operational & Cyber Threats

1

Navigating The Latest Regulations With Confidence:

Stay ahead of expanding and diverging regulatory agendas for constantly improving, future-ready compliance frameworks

2

Compliant & Customer-Focused AI Strategies:

Move beyond the theory of AI towards practical implementation that improves efficiencies and delivers optimised customer experiences

3

Strengthen Fraud & Financial Crime Defences:

From AML and ABAC to customer missteps, reinforce against financial crime to protect customers, stakeholders and employees

4

Risk & Compliance Under A Global Lens:

Unpack the latest geopolitical developments and mitigate against future disruptions and impacts

5

Align ESG, Climate & Sustainability With Evolving Regulations:

Implement climate risk and ESG frameworks into your business operations amidst heightened scrutiny

6

Proactive Operational Resilience:

Embed resilience across your organisation and adopt dynamic frameworks that enable robust and risk-conscious contingencies

7

Safeguard Against Cybersecurity & New Technology Risks:

Identify vulnerabilities across your digital supply chain and prepare for the cybersecurity implications of AI, quantum computing and emerging technologies

8

Mitigate Emerging Risks & Future Threats:

Stay one step ahead and develop proactive strategies to monitor and anticipate potential risks

9

Consumer Duty – What Next?

Build on Consumer Duty implementation to anticipate future developments and ensure fully compliant practices

10

Streamlined Data Analytics & Integrity:

Develop advanced and slick data strategies that are both compliant and cybersecure

Why Join Your Industry Peers This Market-Leading Financial Services Risk & Compliance Event?

- 26+ Risk & Compliance professionals speaking from across financial service, our speaker faculty unites under one roof to share their experiences and insights

- Celebrating our 10th edition of high-impact, high-reward risk and compliance conferences for the Financial Services: this industry-leading event will be the one you do not want to miss in 2026

- AI Implementation, New Regulations, Emerging Operational and Cyber Risks: we shine a spotlight on the hottest topics in the industry, focusing on what you need to know

- Dedicated networking time with top leaders and industry professionals from across financial services – expand your Risk & Compliance network with 2+ hours of networking sessions

- Upskill yourself and your team with real-use cases and actionable tips and techniques to refine your risk and compliance strategies today

- Proven delegate ROI: walk away with practical, actionable strategies from industry-leading FS risk and compliance experts

- Targeted and focused agenda covering the hottest topics facing risk and compliance professionals across the financial services today… uncover brand new, practical, proven, and successful strategies to facilitate new ideas and perspectives

- Peer-led knowledge sharing: join discussion zones to exchange ideas and insights with fellow attendees in an open, collaborative setting

- Gain practical skills and strategies to take back to the office, with the chance to ask your own questions after every session

- One efficient day out of office with maximum value: make the most of this compact, high-impact event in the heart of central London, designed for efficiency and convenience

Who Attends This Market-Leading Financial Services Risk & Compliance Event?

Send 4 delegates for the price of 3 OR send 3 and get your third place half price!*

* This applies to inhouse practitioners only, not agencies and suppliers, and cannot be used in conjunction with any other discounts, including earlybird offers.

Thank You To Our Partners...

Partner With Us – Speak, Sponsor, Exhibit Or Connect Through One-to-One Meetings At The

Risk & Compliance Financial Services Conference

Can You Help Financial Services Risk & Compliance Practitioners?

Book An Exhibition Stand + 2 Delegate Places

Book Today For Just: £4,999+VAT

For more information on how to get involved, please call +44 (0)20 3479 2299 or email

Please remember to check your junk folder for the brochure – and add @gicconferences.com to your safe senders list.

What Our Previous Attendees Have To Say...

Join Us At Our Sister Events:

Global Insight Conferences is a rapidly-expanding and highly entrepreneurial conference company. We only employ individuals who are passionate about conferences, passionate about their personal growth and performance and passionate about being the best.

Please send your CV with a covering letter to hr@globalinsightconferences.com